Table of Content

While the process is relatively straightforward, there is no way to apply online on the Kaiser Permanente website. SeniorLiving.org is compensated when you click on the provider links listed on this page. Any payments you make before an appeal is approved and will not be refunded.

Nursing care may include getting shots, using a feeding tube, and changing dressings. Special care units are offered at some residential care centers and skilled nursing facilities. There are also facilities that accept only people with dementia. Assisted-living and residential care facilities offer a range of services. These services may include meals, cleaning and laundry services, and help with personal needs such as bathing, grooming, and dressing.

Which Insurance Plans Are Accepted At Cleveland Clinic

… Those who have the Kaiser Permanente Medicare Advantage Plan or another commercial plan from the company that includes senior care in a nursing home or skilled facility will gain this type of coverage. You can apply for medical financial assistance through Kaiser Permanente during or following a course of care or treatment received from Kaiser Permanente. The Medical Financial Assistance program helps low-income, uninsured, or underinsured patients who need help paying for all or part of their medical care received from Kaiser Permanente. Patients are eligible for financial assistance when their family income is at or below 400% of the Federal Poverty Guidelines . Patients should consult with a counselor to determine eligibility and for assistance applying. Patients who have experienced unusually high medical expenses may be eligible for the program, regardless of household income.

If you choose a Medicare Advantage plan , your coverage may include prescription drug costs . Survey data collected by Medicare reveals that Kaiser’s Medicare Advantage policyholders are very happy with their coverage, their ability to get prescriptions and the quality of their health care. In contrast, enrollees give the company lower ratings for their ability to get health care and coordination of care, such as follow-ups after tests.

What is In-Home Supportive Services?

Medicare patients can receive both if they’ve met the home health criteria. For Medicare patients who have met the home health criteria, home healthcare is covered for conditions not related to the terminal diagnosis while the patient is on hospice. Home care is more affordable that many realize, as 49% overestimated the cost by more than $6 an hour, a recent Home Instead Senior Care poll shows. On the other hand, the average yearly cost of nursing home care is $70,000—nearly 75% more than home health care. Kaiser Permanente Home Health Care provides high-quality care to members who are homeboundand have a skilled needof a nurse or a therapist.

Even before the pandemic, Kaiser Permanente Northwest was planning the KP@Home program, a virtual hospital that duplicates hospital-level care and treatment in the patient’s home. With the spread of COVID-19, there are concerns about hospital overcrowding and keeping noninfected patients safe. The optimal age to shop for a long-term care policy, assuming you're still in good health and eligible for coverage, is between 60 and 65, financial advisers say. To get started, work with your doctor, social worker, hospital discharge planner, or geriatric care manager to help find which type of long-term care would be best for you or your loved one.

What age should you buy long-term care insurance?

A Hospice nurse will call to talk to you about the Hospice program and determine if you qualify. You may receive a follow-up phone call to see how you are doing and give you a chance to ask questions. At the start of care the RN case manager will assesses your clinical situation and develop an individualized care plan including the frequency of visits. Aides are available 24/7 to assist residents with personal care tasks or in the event of an emergency. At an average cost of $4,300 per month in the United States, it is significantly less expensive than around-the-clock in-home care. Kaiser Permanente Insurance to Pay for In-Home Care From an insurer’s point of view, it is less expensive to provide in-home care for an individual than it is to provide long-term care in a hospital setting.

In this category, health insurance pays for all care a patient requires as long as it can meet their needs both physically and psychologically. Some Kaiser Medicare Advantage plans feature a $0 yearly deductible and $0 copays for preventive care. Kaiser Part C plans may also provide local and online wellness programs, including prediabetes coaching, mental health help and a host of other holistic support resources.

It’s based on what you want to do, as well as what you are physically able to do. No, but as your disease progresses you may continue discussions with your Home Based Palliative Care team to modify your plan of care. Typically, the daily rate for most home care agencies ranges from $200 to about $350 per day. This, of course, is dependent on the cost of living within your given region as well as the amount of specialized care that you need as a client. Kaiser Permanente offers free and discounted non-medical services for older adults.

When you begin Hospice, your Hospice physician will create a new medication plan for your medical needs. The focus will be on comfort and treatment of symptoms, like pain, shortness of breath, or anxiety, so some of your medications may no longer be recommended or needed. The Hospice care team can tell you what to do with those medications, which may include stopping them, as well as provide instructions on your new medications. The goal of Hospice care is to provide a comfortable life, away from the inconvenience or discomfort of excessive or unhelpful medical treatments. The Hospice care team, often working together with your other doctors, can manage your care without the need for regular doctor visits.

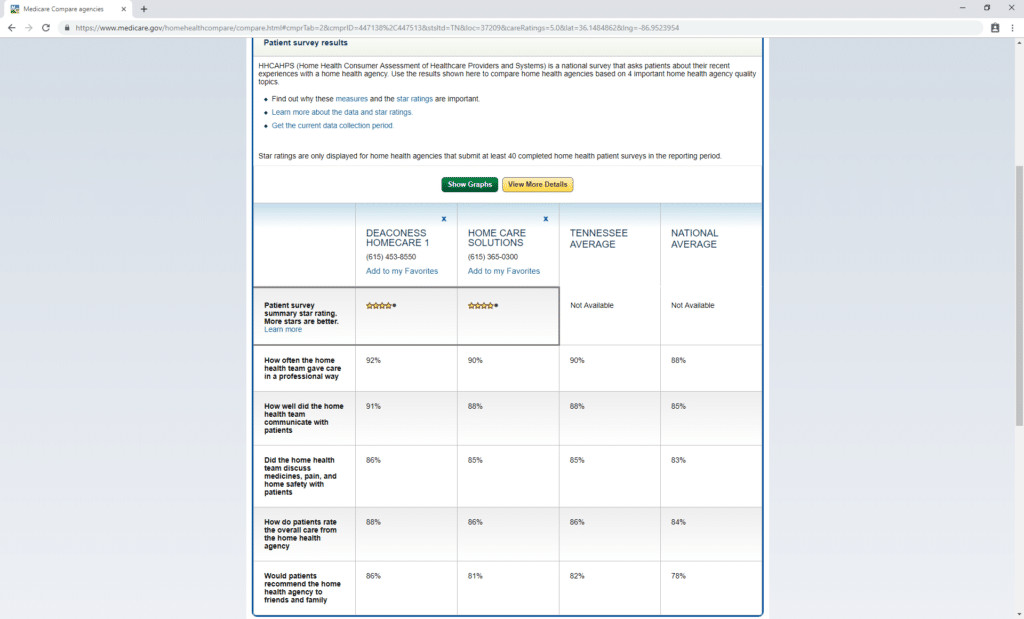

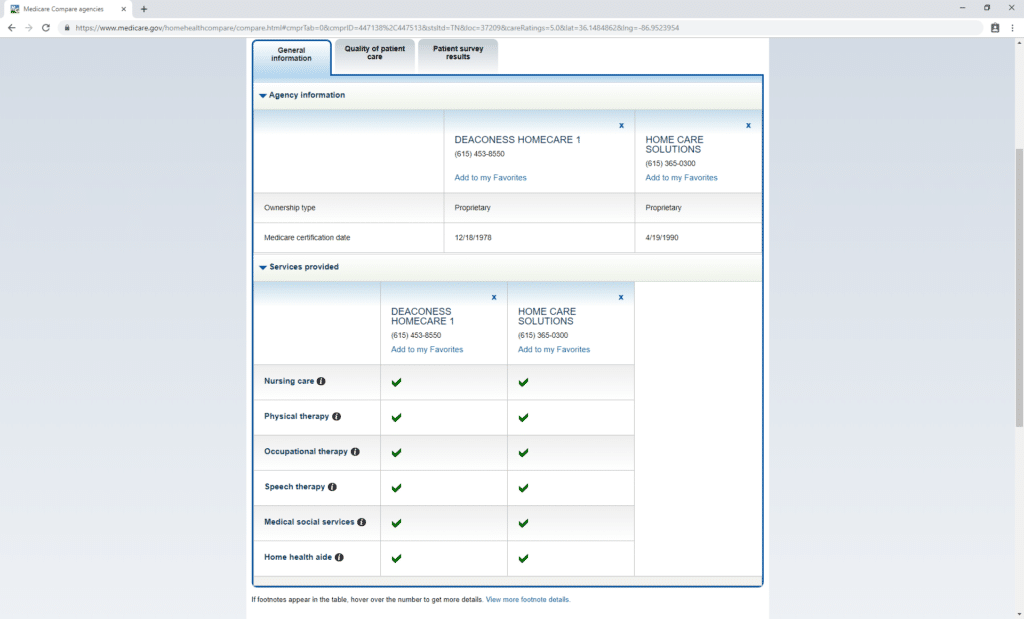

As you or a family member ages, you may have concerns about how to manage health problems. Most people would like to stay in their homes and have family members help them out. But talking with the home health agency may help you feel more comfortable about their services and staff.

Hourly rates for home care vary by as much as 50% even in the same state or town. Nationwide in 2019, the average cost for non-medical home care is $21.00 per hour with the state averages ranging from $16.00 – $28.00 per hour. It should be noted that these are average costs from home care agencies. Understanding how Medicaid covers medical supplies and equipment can help you make the most effective ...

They might also have their blood drawn for lab tests and receive care for incisions or wounds. The home health care staff will also send details of a person’s care to their doctor and report on their condition. You may need follow-up care at home after surgery or an injury, and the Kaiser team works to help you recover as quickly and completely as possible. Depending on your condition, you may have visits from various caregivers or specialists.

Although minor and infrequent medical services, such as first-aid for a wound, can sometimes be met on-site by nurses. These communities may sometimes also be called ALFs, residential care facilities, retirement homes, or long-term care facilities. During a virtual hospital stay, the patient is digitally tethered to a Kaiser Permanente physician who connects with the patient daily and can order hospital-level care, right down to medically tailored meal delivery. A nurse practitioner does home visits regularly, and paramedics can administer medication as needed. Should anything come up, the patient can initiate a face-to-face meeting with his or her nurse via an iPad, phone, or medical alert bracelet. In general, the income from a long-term care insurance policy is non-taxable, and the premiums paid to buy the insurance are tax deductible.

No comments:

Post a Comment